Planning for Retirement

Planning for Retirement –

Tips and Strategies for a Secure Future :

Planning for retirement is a crucial aspect of financial management that many individuals tend to overlook. Retirement planning involves setting aside funds and making investments that will provide a steady source of income during one’s golden years. With the advances in healthcare and technology, people are living longer than ever before, making it essential to plan for retirement to ensure a comfortable lifestyle.

One of the primary reasons to plan for retirement is to maintain one’s current standard of living. Many people rely on their income to pay for their daily expenses, such as housing, food, and transportation. Without an income source during retirement, these expenses can become challenging to manage, leading to a significant decline in the quality of life. Retirement planning can help individuals maintain their current lifestyle by ensuring a steady stream of income during their golden years.

Retirement planning also provides individuals with a sense of security and peace of mind. Knowing that one has enough funds to support themselves during retirement can alleviate stress and anxiety. It can also help individuals prepare for unexpected expenses that may arise during retirement, such as medical bills or home repairs. By planning for retirement, individuals can enjoy their golden years without worrying about financial constraints.

Retirement planning also provides individuals with a sense of security and peace of mind. Knowing that one has enough funds to support themselves during retirement can alleviate stress and anxiety. It can also help individuals prepare for unexpected expenses that may arise during retirement, such as medical bills or home repairs. By planning for retirement, individuals can enjoy their golden years without worrying about financial constraints.

RELATED ARTICLES:

Loneliness and Depression in Seniors

Benefits of Senior Dance Therapy

Best Anti Aging Secrets

Planning For Retirement:

Assessing Your Retirement Goals

Determining Your Retirement Income Needs

When assessing retirement goals, it’s important to determine how much income you will need in retirement. To do this, you should consider your current expenses and any changes you anticipate in the future. It’s also important to consider any sources of retirement income you will have, such as Social Security, pensions, or other investments.

One way to determine your retirement income needs is to use a retirement calculator. These tools can help you estimate how much you will need to save to meet your retirement goals. You can find retirement calculators online or through financial advisors.

Planning For Retirement – Assessing Your Current Retirement Savings

After determining your retirement income needs, it’s important to assess your current retirement savings. This includes any retirement accounts you have, such as 401(k)s or IRAs. You should also consider any other investments or assets you may have that can be used for retirement.

To assess your retirement savings, you should determine your current savings rate and compare it to your retirement income needs. If you’re not saving enough, you may need to adjust your savings rate or consider other options for increasing your retirement savings.

Planning For Retirement – Exploring Retirement Options

Planning For Retirement – Exploring Retirement Options

Finally, when assessing retirement goals, it’s important to explore retirement options. This includes considering when you plan to retire, where you plan to live, and what activities you plan to pursue in retirement.

You should also consider any potential risks to your retirement goals, such as inflation or market volatility. By exploring retirement options and considering potential risks, you can better prepare for a successful retirement.

Creating a Retirement Plan

Retirement planning is an essential part of financial planning. To ensure a comfortable retirement, it is essential to create a retirement plan that takes into account various factors such as savings, budget, healthcare costs, and social security benefits. Here are some sub-sections that can help in creating a comprehensive retirement plan.

Developing a Retirement Savings Plan

Developing a retirement savings plan is the first step in creating a retirement plan. It is essential to save money regularly and invest it in a diversified portfolio to ensure that it grows over time. The following table shows the recommended savings rate based on age and income.

Creating a Retirement Budget

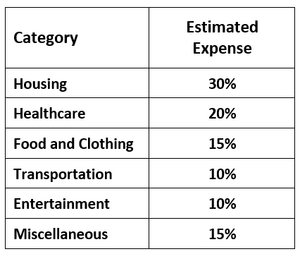

Creating a retirement budget is the second step in creating a retirement plan. It is essential to estimate the expenses that will be incurred during retirement and plan accordingly. The following table shows the estimated expenses based on various categories.

Planning For Retirement Health Care Costs

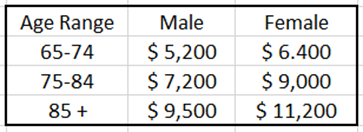

Planning for healthcare costs is an important part of retirement planning. Healthcare costs can be significant during retirement, and it is essential to plan for them. The following table shows the estimated healthcare costs based on age and gender.

Maximizing Social Security Benefits

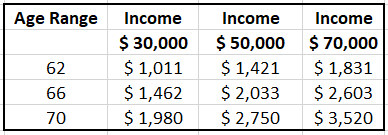

Maximizing social security benefits is the final step in creating a retirement plan. Social security benefits can be a significant source of retirement income, and it is essential to maximize them. The following table shows the estimated social security benefits based on age and income.

In conclusion, creating a retirement plan is essential to ensure a comfortable retirement.

By developing a retirement savings plan, creating a retirement budget, planning for healthcare costs, and maximizing social security benefits, individuals can create a comprehensive retirement plan that meets their financial goals.

By developing a retirement savings plan, creating a retirement budget, planning for healthcare costs, and maximizing social security benefits, individuals can create a comprehensive retirement plan that meets their financial goals.